Intelligent investment decisions can minimize risks, enhance rewards, and yield substantial returns. As you begin your investment journey, several critical questions arise. What motivates you to invest? At its essence, investing is not just about growing your wealth; it's about outpacing inflation and securing your financial future. Understanding the principles of what is investment and where to invest money is key in navigating this path. This guide aims to shed light on these aspects, providing a comprehensive beginner's guide to investing.

- Blogs

- Finance & Banking

- Smart Investing Guide For Beginners 657b003114e5bf000128e110

Smart Investing Guide for Beginners

Finance & Banking • 14 Dec, 2023 • 23,881 Views • ⭐ 3.0

Written by Shivani Chourasia

Saver or Spender: Which Are You?

A 2019 Charles Schwab survey uncovered that 59% of Americans see themselves as savers. However, recent trends show a shift: 63% now live paycheck to paycheck, highlighting a mismatch between financial goals and actions. This disparity suggests that while many aspire to financial security, the steps to achieve it aren't always clear. The traditional belief is that saving is the direct path to accumulating wealth and financial freedom. However, this is only a part of the truth. Although saving is a fundamental component, effectively learning how to invest money can significantly enhance your ability to achieve financial goals. The reluctance to invest often stems from a fear of financial loss, overshadowing the potential for gains.

Why to Invest?

Investing and saving are two integral aspects of financial planning, often discussed in any investment guide. While saving provides the necessary capital, investing is what truly grows this capital. It's not just about keeping up with inflation; it's about leveraging the power of compound interest for long-term growth. For beginners, understanding how to invest in mutual funds and other investment vehicles is a crucial step towards financial security.

FINANCE & BANKING QUIZ • 10 QUESTIONS • 2 MINS

We've got a Finance & Banking quiz for you!

TAP TO PLAY

Balancing Savings and Investments

Determining the right balance between saving and investing depends on individual circumstances. A general guideline is to save 20% of your income, providing a substantial foundation for future investments. Initially, focus on building an emergency fund that covers 3-6 months of expenses. Once this is established, you can start to invest additional funds. Investing wisely over a long period can exponentially increase your capital, making which investment is best a significant consideration.

Understanding Investment Mechanics

To participate in the financial market, you must understand its workings. The market serves as a platform for buying and selling stocks, bonds, and other assets. To enter, one needs an investment account, such as a brokerage account, which differs from a standard bank account. This is the first step in learning how to invest in the share market for beginners.

Stocks and Bonds Explained

In the market, companies raise funds through stocks and bonds. Stocks represent ownership shares in a company, while bonds are akin to loans given to the company, repaid with interest. Understanding the difference between these two is essential for new investors. Stocks are generally more volatile, but they offer the potential for higher returns, making them a key focus in any beginner's guide to investing.

Exploring Diverse Investment Options

The investment world extends beyond stocks and bonds. It includes commodities, precious metals, and real estate. Diversification in these areas can protect against market volatility. For beginners, understanding how to invest in mutual funds online offers a pathway to diversifying their portfolio effectively.

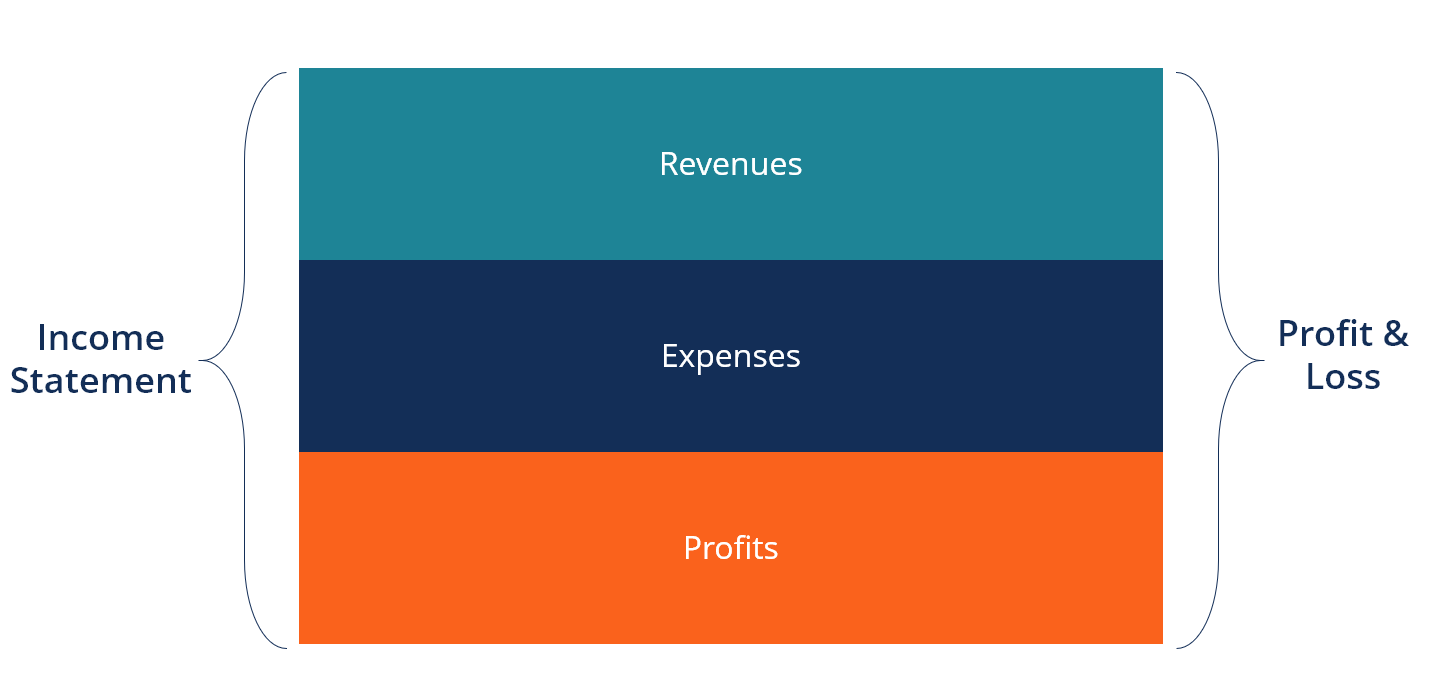

Profits and Losses in Investments

The fundamental concept in investing is buying low and selling high. However, the reality is more complex. Market fluctuations can impact your investments, and understanding when to hold or sell is crucial. The concept of 'realized' gains or losses is an important one, as it dictates the actual financial outcome of an investment.

Investing Wisely

Investment strategies vary widely depending on individual circumstances and risk tolerance. Younger investors, for instance, might favour riskier portfolios due to their longer investment horizons. As one nears retirement, the strategy should shift towards more secure investments like bonds. Understanding your personal investment profile is key to making informed decisions.

The Role of Life in Investments

Life events can significantly influence investment choices. Being realistic about your current financial situation is crucial in making sound investment decisions. This involves assessing your financial health and adjusting your investment strategies accordingly.

Achieving larger-than-average returns usually involves taking on more significant risks. To build lasting wealth, focus on establishing a solid emergency fund, directing savings towards the right mix of assets, and ensuring diversified investments. This approach balances risk and reward, paving the way for a secure financial future.

Conclusion

While the strategies outlined in this guide do not guarantee absolute financial independence, they provide a solid foundation for embarking on your investment journey. Emphasizing the accumulation of savings, strategic investment decisions, and the importance of portfolio diversification lays the groundwork for building long-term wealth. Remember, the journey of investing is ongoing and dynamic, adapting to changes in your life and in the market. By remaining informed, making calculated decisions, and regularly reassessing your investment strategy, you can navigate the complexities of the financial world. This approach boosts your potential for financial growth and enhances your understanding and confidence in managing your financial future, setting you on a path toward sustained wealth creation and financial security.

Test your Finance & Banking Knowledge! Visit:

https://4123.play.quizzop.com/finance-and-banking-quiz/category

Rate this article

Other articles you may like

Financial Inclusion in Rural India: The Role of Microfinance and Small Finance Banks

Finance & Banking • 10 Oct, 2023 • 24,591 Views

The Evolution of Central Banks: From Gold Reserves to Cryptocurrency

Finance & Banking • 9 Oct, 2023 • 22,932 Views

Demystifying the Digital Payment Ecosystem in India

Finance & Banking • 9 Oct, 2023 • 22,704 Views